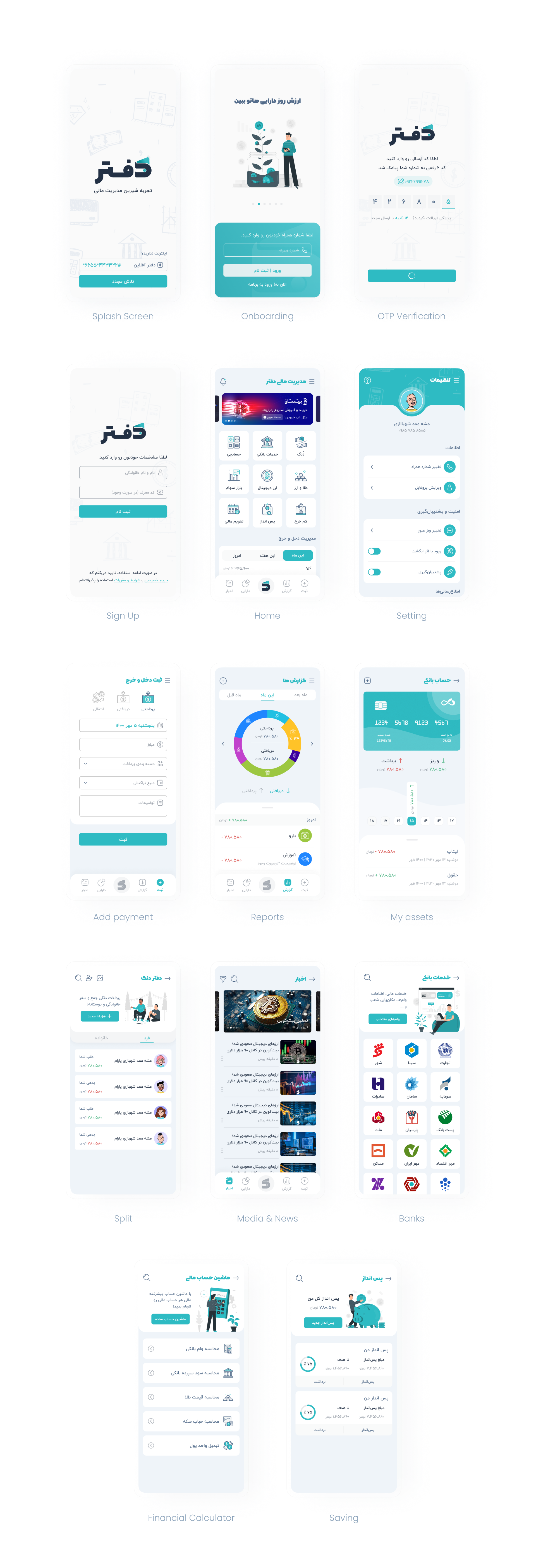

Daftar

Create a new experience better than the current situation with the help of a mobile application for the salaried community to design so that they can achieve financial goals and vision as well as monthly savings, along with more control and awareness of expenses and changing the financial pattern.

| Year | 2022 |

| Collaborators | Mohammad Shahbazi, MohammadHossein Heydarzadeh |

| Website | daftar.app |

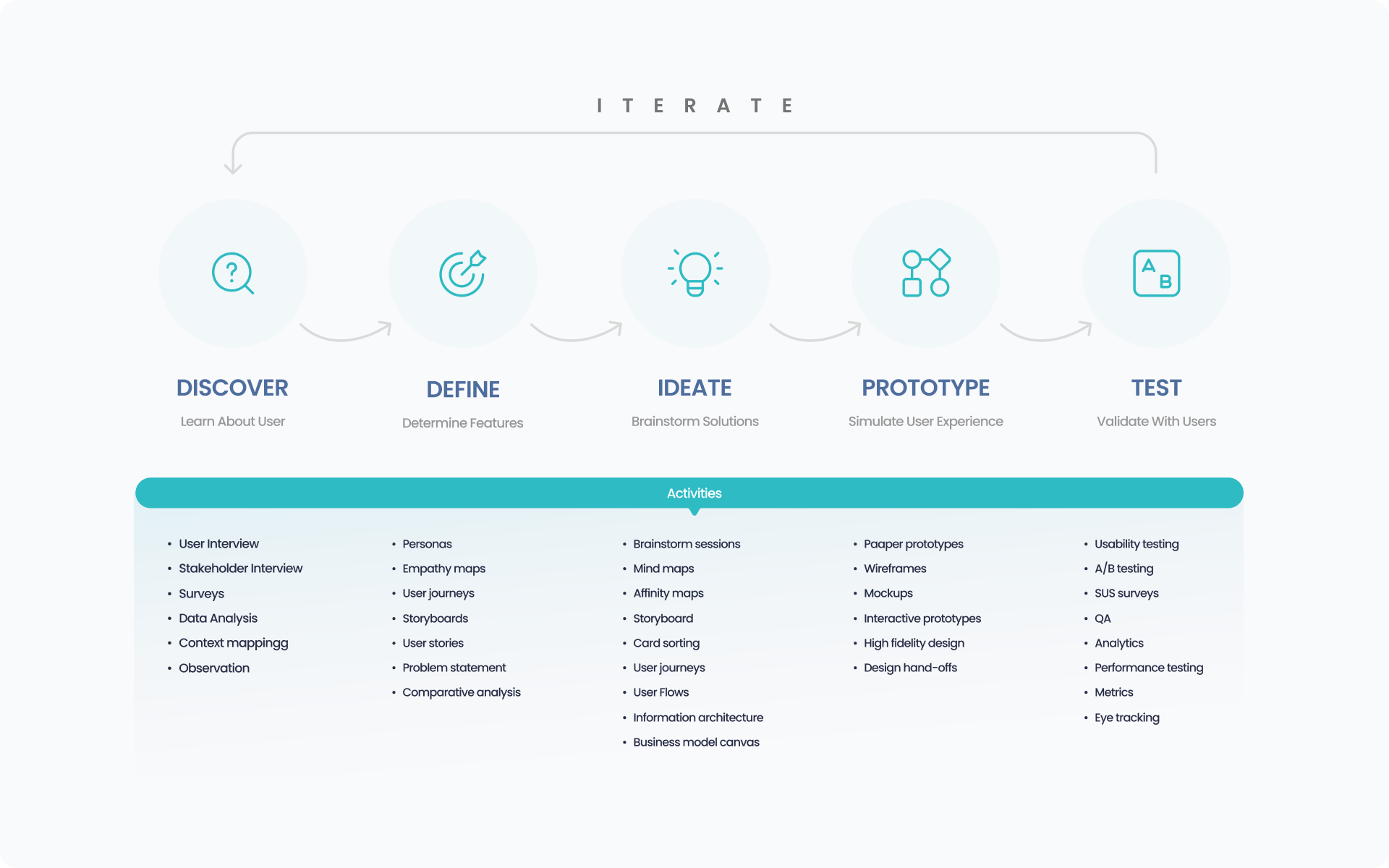

Our Process

Problem Statement

One of the efforts of people to be satisfied with the times, especially in competitive urban life, has been to achieve prosperity and continuous financial growth, and in line with this goal, perhaps the most basic solution that comes to mind is to increase income or increase revenue channels, but the truth is that An increase in income does not necessarily lead to greater financial well-being. The general public, on the other hand, has fewer opportunities to start a personal business. Therefore, the financial input of the life of this society is almost constant. The question here is how to achieve financial goals such as saving or even buying a house or car by considering a fixed income and various expenses? For this challenge, we want to design a new and better experience than the current situation with the help of digital products.

Reaserch

Target group

• Low-wage earners are in savings but need more careful management of their income and expenses • The breadwinners of the family • Young couples • Independent students • Newly independent youth

Objectives & Goals

• A simple and valuable solution for the target group • Opportunity to implement a sales model is possible

The understanding user through Research

To discover the most importantly real and unmet needs of the idea audience in cost control and achieving financial goals, I decided to plan for the research and did so with a questionnaire and interview.

Purpose of the research

• Awareness of the ability and behavioral patterns of controlling the cost of idea contacts • Idea audience segmentation • Awareness of current contact methods in saving and controlling costs

Expected result or achievement

Discover and identify current ideas for saving, controlling costs, and achieving financial goals.

My own mental questions

• How do people spend their monthly budget? • How do people manage their expenses? • How do people check their expenses during the month or at the end of the month? • How do they save on variable costs? • Do they save? How do they save on their monthly income? • What do they save for? • How do they solve the problem during financial crises?

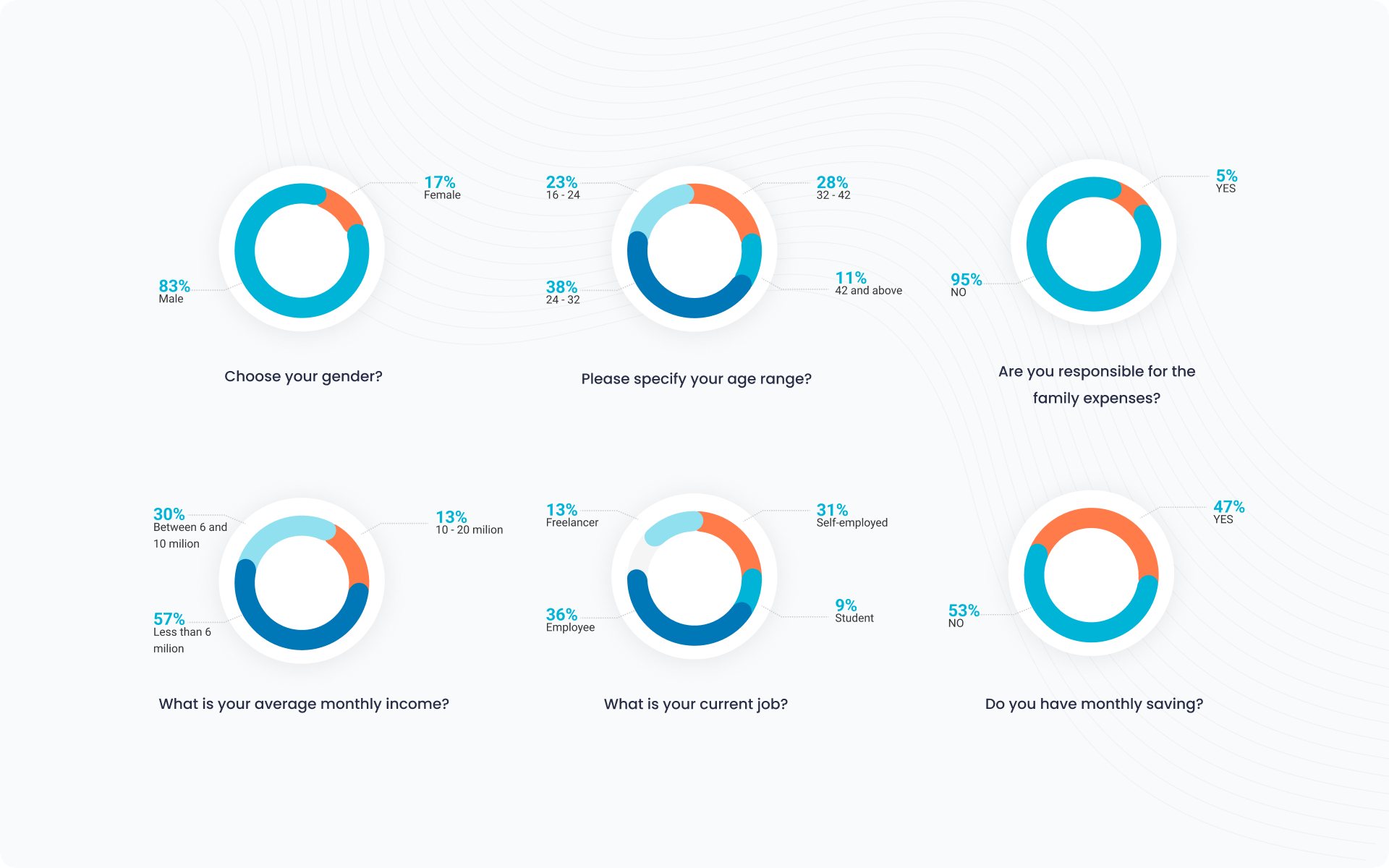

Primary Research

To conduct user interviews, the next step was to create the surveys to find my target users. The users were recruited through a screener form who fit into my target user group to move forward for the interview. Here are the statistics of the responses which I received from the survey:

User Interviews

Before I started the interviews, I prepared a session guide with a set of questions to understand the user’s challenges: their experience, needs, expectations, etc. After framing the questions, I went ahead and conducted user interviews with 5 users over a period of two days and each of them lasted for about 30–40 minutes. I got a lot of information from the 5 users whom I chose to interview.

User Needs

• The need to distinguish and identify situations that lead to the financial crisis • Need to be prepared for unpredictable costs • Need to report the current financial situation • Need to control and allocate funds to expenditures

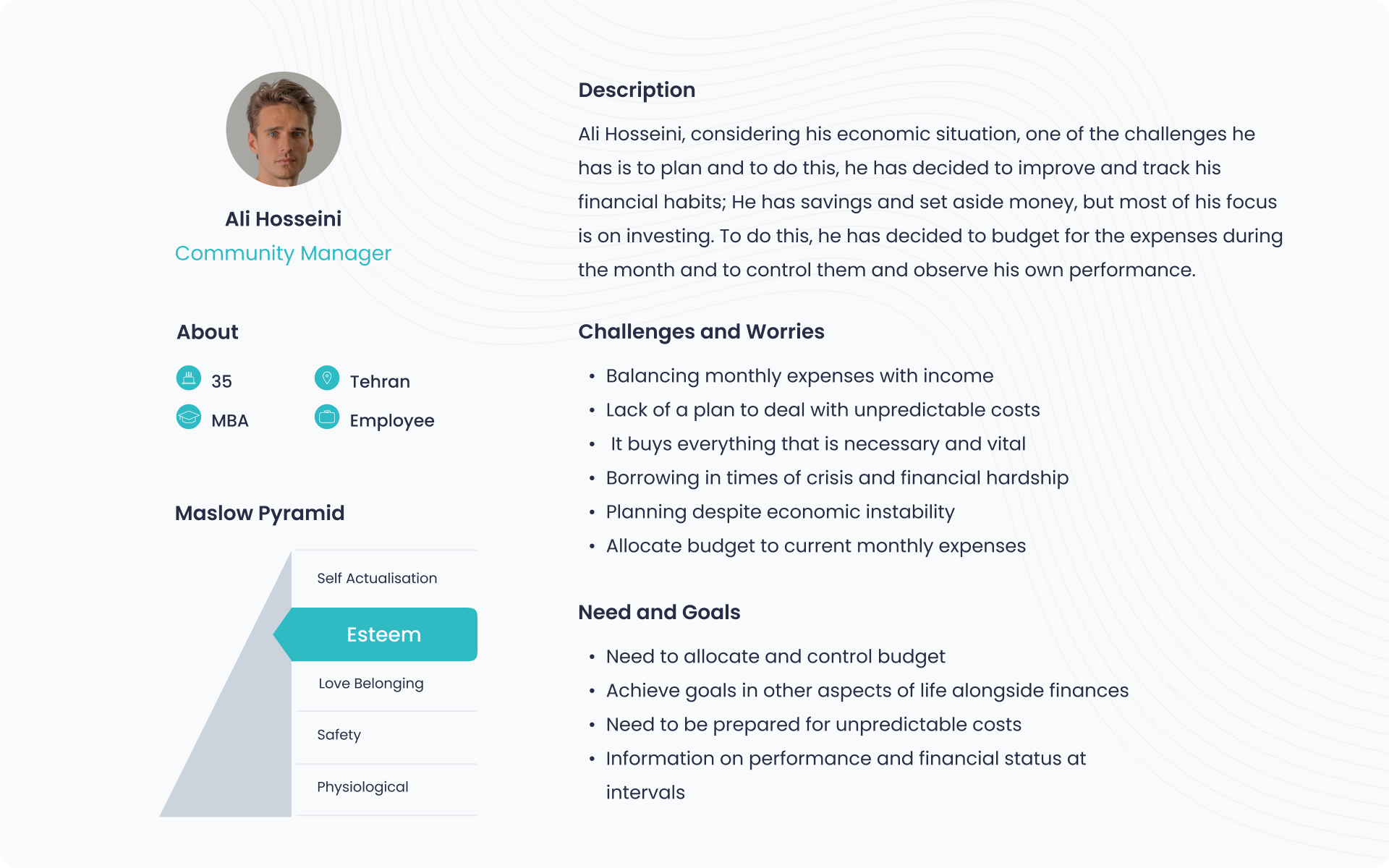

User Persona

The results of my survey revealed that there were several types of users with diverse needs. The accumulation of the different insights and common patterns that came from the users’ answers helped me create three personas, which are the manifestation of that data in a character. At this step, I’ve summarized the common behaviors for each persona to communicate their goals and motivations.

Here, we can see their preferences on how to solve the problems, goals, frustrations, needs, and device usage.

Reframing the problem statement

Post research, after analyzing all the insights I tried to reframe the problem statement to proceed and build wireframes. Ali Hosseini has poor spending habits and control over finances. For this reason, one of its challenges is to balance the expenditure income with the planning of its expenditures, and for this, it needs to allocate, control, and budget for current expenditures so that it can achieve its financial goals by saving and controlling expenditures.

Main Solution

Better understanding of costs and revenue by recording transactions and viewing reports, controlling costs by budgeting.

Competitor Analysis

At this stage, I began my research by examining several competitors or similar platforms, UI analysis, UX, user stream, IA, and key features. I found that we have many platforms related to personal financial management with different capabilities and different focuses on needs.

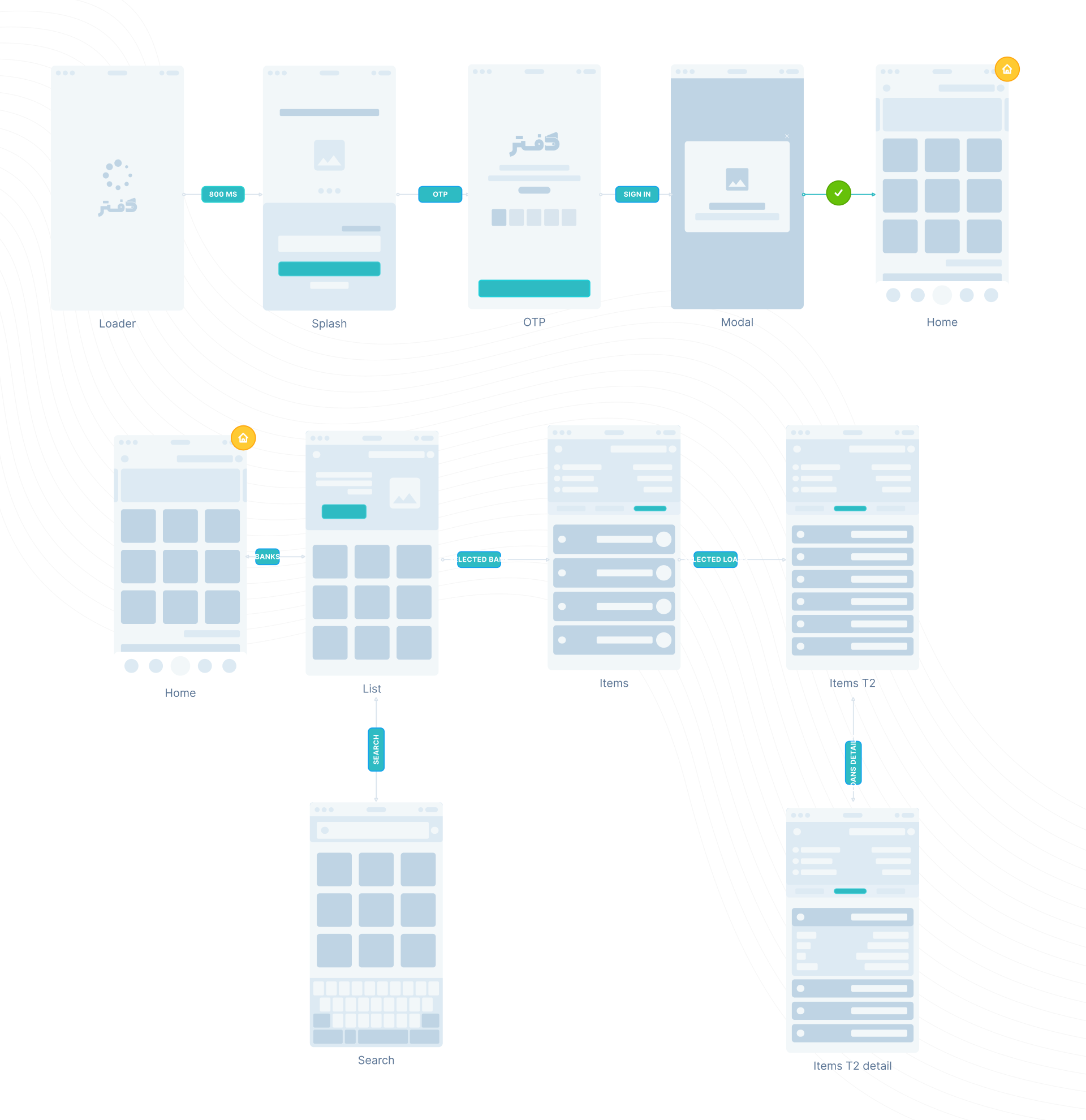

User Flow

After finalizing my ideas, I created a user flow with the main features of the application that can help the user in this problem.

Design